Africans have a peculiar sense of humor. When asking 'Comment ça va à Kinshasa?', an answer often heard used to be "Mieux que demain" ('Better than tomorrow'). It adequately describes what mood precious metals are in. Irrespective of whether global stock markets are dipping or recovering and challenging all time highs, precious metal markets know only one direction. A summer slump is a recurrent phenomenon, yet now it lingers on from mid May onward.

(drafted over the WE, with fresh comments added)

Triple digit platinum (as I stated was in the cards) ultimately materialized last Friday. (Previous occurrence of triple digit Platinum was in February 2009, which puts us at a +6 year low.) Gold closing at $1133 puts us at a five year low. For an LBMA silver fix below the current $14.84, we equally need to return to Sept 1, 2009. While Palladium 'only' is near a three year low, its price has been plunging faster than any of the other precious metals.

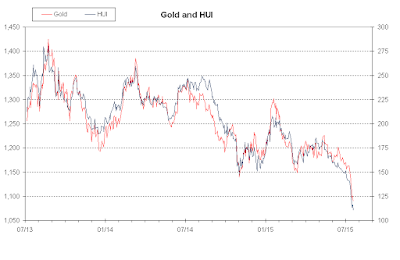

Miners have been crashing, with the HUI/Gold ratio now below its December 2014 trough at 0.114. The HUI index equally slid considerably below its mid December 2014 bottom level. You find fresh graphs on the

gold miner pulse blog page. Since the previous update on Jul 6, the HUI posts a 15.1% loss, while the benchmarks GDX and GDXJ are off -13.6% and 11.1% respectively. SIL slides 13.45%.

With a 8.69% loss, our

contributor driven explorer & junior miner spreadsheet compares favourably, if that can be any consolation. We thereby equal the performance of GLDX (the explorer ETF) which was the less bad of our benchmark ETFs. Since last update, there are 2 list components up little (PVG and CNL), against 15 down, with Eurasian Minerals flat. Several double digit slides are a drag on our list performance.

***

Yesterday the slide aggravated with gold breaking below $1100 for the first time since 2010: a fresh 5 year low. Few miners lost more on a day than they did year-to-date. Today's timid recovery won't bring about any substantial improvement.